Capital Allocation & Management

Allocating and managing capital in the digital asset space is a complex endeavor and investors still face significant hurdles to participate effectively in these markets.

Blockchain technology is increasingly sophisticated and rapidly evolving. Capital allocators require a deep understanding of the underlying technologies to properly analyze and make investment decisions. Furthermore, executing transactions using these protocols is still not an intuitive process. User interfaces are not friendly enough for the average individual and lack traditional safeguards thereby exposing investors to costly mistakes. And, without proper security and custodial precautions, inevitable security attacks may generate significant losses.

In addition to that, there are currently limited alternatives in the market globally for institutional and professional individual investors to allocate capital efficiently in these assets and a large number of value creation opportunities in the blockchain industry fall outside of the publicly-accessible and open cryptocurrency space.

This is where Lvna comes in - we provide efficient and comprehensive solutions for sophisticated investors interested in diversifying their portfolios through allocations in the digital asset space.

Focus on Protocols

Like those of today's internet (e.g., TCP/IP, SMTP), open-sourced and decentralized protocols are poised to hold and be used to transfer around the world massive amounts of value. Therefore, they need to be scalable, robust and secure. Revolutionary technological developments take years to perfect and most protocols on top of which cryptonetworks exist are, in our view, still in a developing phase, with much R&D, implementation and testing required before they are ready for mass adoption.

Nevertheless, we are optimistic that the ecosystem's ambitious and lofty goals will be achieved in the long-term. In the meantime, Lvna's team focuses its financial and human capital on improving and growing the leading protocols in the space. Once the necessary infrastructure is in place, we may assign capital to value-enhancing, decentralized applications built on top them. But, for now, we stick to what we understand and believe is required for the eventual success of the technology.

Portfolio Construction

We are practical investors. While we are hard core believers in the potential of decentralized ledger technology, we prioritize that we have a fiduciary duty to maximize long-term value while managing market and security risks. So, we take advantage of our unique position to maximize risk-adjusted returns.

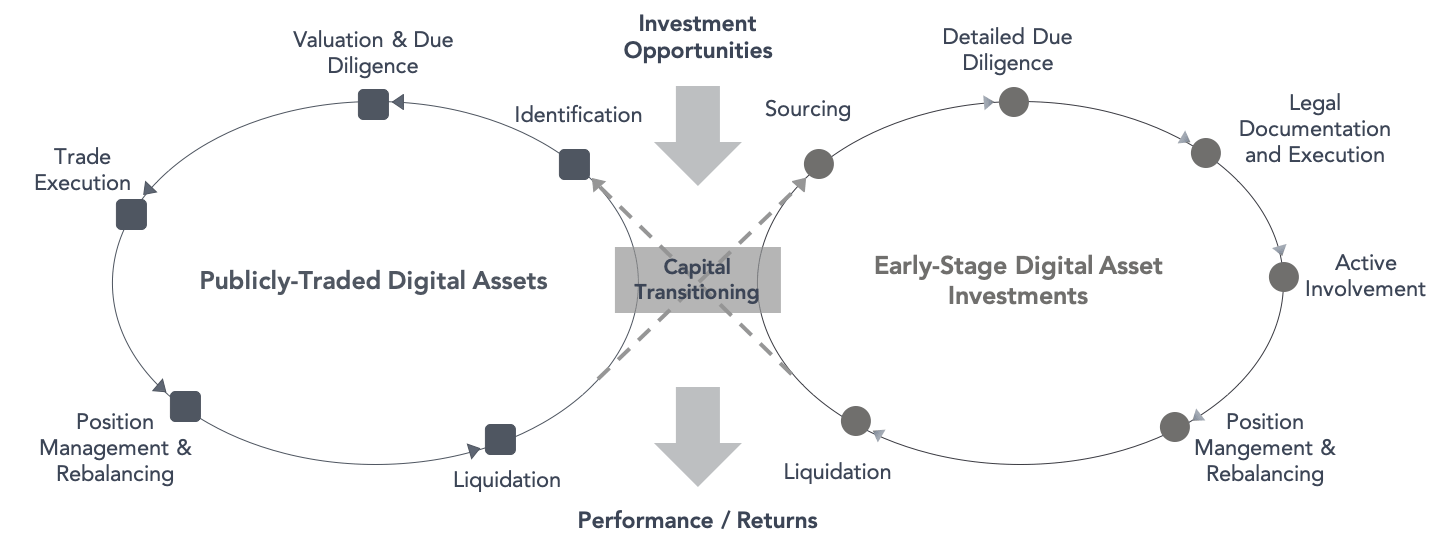

To that end, we've designed a balanced, long-term execution program. We construct and dynamically adjust our portfolio based on two primary strategies and two types of positions:

- Investments in publicly-traded digital assets with meaningful liquidity in leading exchanges around the world. Core positions are those we intend to hold for 5 to 10 years, at least. Bitcoin's properties are that it is immutable, programmable, permissionless, censorship-resistant, non-sovereign, global and scarce money. Today, we firmly believe, for instance, that those features coupled with significant liquidity and third-party infrastructure will continue to lead the ecosystem forward. Other assets we consider core are ETH and DCR.

To a lesser degree, we take opportunistic positions in assets that we believe will generate significant value in the short- to medium-term as a result of a specific catalyst, taking advantage of strong and abrupt market movements. - Early-stage investments through SAFTs or private equity transactions in projects that intend to issue digital assets at some point in the future. We source, filter and take core positions in the earliest capital raising rounds in projects led by highly-skilled teams building technologies with massive growth potential. Since inception, we've gained access to some of the most prominent projects in the space, including Algorand and Blockstack, at attractive valuation levels. In exchange, we deploy all our resources to provide active financial, business, community and technological support to the teams.

As investments mature and new opportunities present themselves, we transition capital between these two strategies.

Technical Due Diligence and Involvement

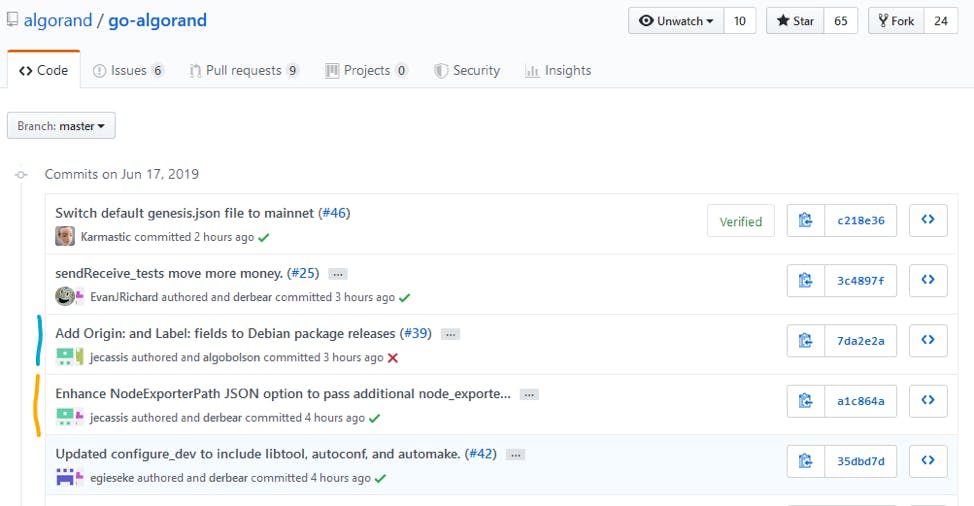

Lvna is particularly proud of its technically-proficient team. While our due diligence process also encompasses business, financial, economic, and game theoretical matters (among many others), our primary focus is on the technology. We spend as much time as we need to understand the projects that we allocate capital to, such that we maximize the probability of exclusively selecting state-of-the-art, high-impact technologies. Our active, day-to-day work in various projects give us additional insights on the inner workings of the different protocols and their relative efficiency, as well as the tech team's capabilities and development progress.

Because we acknowledge the complexity of building and shipping protocols with the potential to change the world, we get actively involved with core developers to analyze and, once we invest, contribute to the following, but not limited to, areas:

- Review and directly contribute to in-development source code and associated infrastructure through audits, issues, and pull requests.

- Run testnet and/or mainnet nodes and provide telemetry and feedback, as appropriate.

- Run long-term validating nodes with enough resources, redundancy, and stake to improve security, increase decentralization, and generate semi-passive returns for our partners.

- Report issues promptly and test fixes when asked.

- Suggest refinements and updates to technical documentation.

- Benchmark the software on different hardware configurations.

- Test client update rollouts and new features.

- Develop procedures for secure deployment, monitoring, and operation for third-parties.

- Exercise the client APIs pre- and post-release.

Active Network and Community Participation

Whether the networks we invest in have been live for years, are in the bootstrapping process or will be launched in the future, we always participate actively. We understand that network security is, in part, a function of decentralization, so we have invested in cutting-edge infrastructure to run full validating nodes and, in specific cases, participate in consensus. This allows us to generate semi-passive returns for our partners and, at the same time, provides us with the necessary raw data to perform deep analysis of on-chain activity.

In addition, we recognize that, as early investors and/or regular users, we have the obligation to actively participate in critical governance decisions, whether those are made on- or off-chain. We submit votes when required, contribute to forums and general discussions, and assist in business development and economic decisions to promote long-term network sustainability.

Finally, as one of the leading participants in the underserved LatAm region, we frequently engage with regulators and traditional businesses to improve their understanding of the technology and its benefits, and advise them on their blockchain strategy. We also continually strive to enhance project visibility by speaking in conferences, bringing in local partners, being ambassadors and hosting sessions and meetups.

Risk Management

Investors participating in digital asset markets face risks that are not present in traditional markets investing. We actively identify, analyze, and manage these risks as early as possible, so as to minimize their impact and protect our partners' capital. In particular, we have particular focus on security and custody, for which we have strict protocols and procedures specifically designed to mitigate inherent industry risks. We also engage with professional third-party service providers, who provide custodial and insurance solutions to safeguard our assets.

In summary, we consider ourselves desirable, long-term investors and stewards of institutional capital, as we continually strive to add both monetary and non-monetary value to the projects we invest in and to generate extraordinary risk-adjusted returns. We work as an agile, closely-knit team dedicated exclusively to effectively allocating our partners' capital and managing our portfolio.

So, if you are an accredited investor or a serious project with revolutionary technology and our philosophy resonates with you, don't be shy. Get in touch!