The Times They Are a-Changin’

Dear Partners and Friends,

Let us share with you today why we think the best investor of all time, Warren Buffett, is wrong about Bitcoin. Please direct your attention to the following 3-minute CNBC interview that came out on Monday, in which he briefly discusses Bitcoin. Note how he talks about the efficiency gains brought by the internet and, subsequently, his faltering tone when he is asked about Bitcoin. Be reminded that, in May last year, Mr. Buffett described Bitcoin as “probably rat poison squared”. This time around, however, he seems slightly more informed. He claims that blockchain technology is “ingenious”, which leads us to believe he is less convinced about Bitcoin’s ‘imminent failure’. Yet, sadly, he has to try to keep his rhetoric intact.

We are confident that Bitcoin will succeed in the long-term and, if Bitcoin itself doesn't, a similar alternative will. And, if none of them do, it won't be for the reasons that Warren Buffet, Jamie Dimon, Ray Dalio and many other 'traditional' investors state. We acknowledge it's easy to dismiss our opinions especially when comparing them with those of these high profile individuals, but please indulge us for a couple of minutes. You can then judge if we make a reasonable case or not.

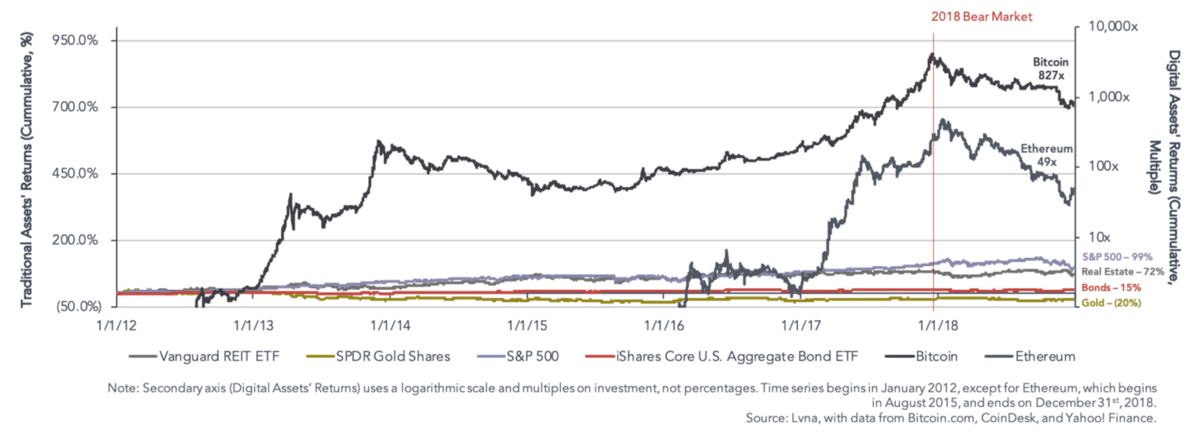

- Since 2013, Mr. Buffet has been attacking Bitcoin. He has been wrong since then and, we believe, will continue to be wrong going forward. Why? Well, even considering the 2018 bear market, during the past decade, digital assets have outperformed traditional asset classes, including real estate, gold, stocks and bonds, by multiple orders of magnitude. In the next decade, we believe this will continue to be the case, especially as the world continues to destabilize and countries face economic pressures.

- Critics, like Mr. Buffet, argue that Bitcoin has no value; however, if that were the case, then annual transaction volumes within the Bitcoin network would not have exceeded US$3.2 trillion in 2018 (6x the volume of Paypal for the same period). Valueless assets have no real world utility. It is easy to declare Bitcoin useless, but actual data points in a different direction. People in emerging markets and countries with capital restrictions have certainly adopted Bitcoin and at increasingly faster rates. Bitcoin may not be useful for Messrs. Buffet, Dimon and Dalio, who live comfortably in the U.S., but certainly for Carlos Hernández, a Venezuelan economist who claims that Bitcoin saved his family.

- This is not the first time Warren Buffet has been wrong. Not everyone is aware of the fact that he's said multiple times that he was wrong about Amazon and Google. And there's no doubt about it - he missed two of the most profitable investments in the recent past. His batting average is nothing less than impressive; however, his skepticism regarding tech companies limits the investment universe he can tap into in this era digital information.

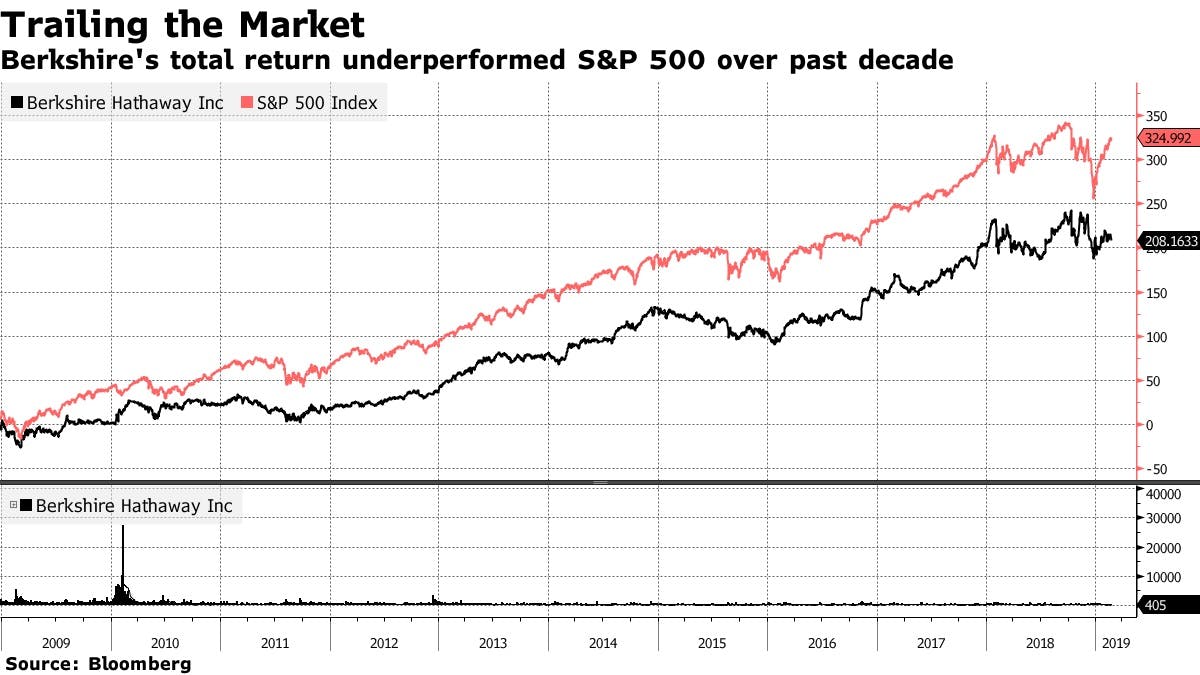

Mr. Buffet's value investing philosophy, which he has pioneered, makes sense and has certainly been very profitable in the last decades. It turns out, however, that certain companies (and Bitcoin, among other innovative opportunities) do not fit well within Berkshire's investment thesis, as they are not traditional businesses. As the years have gone by, the markets have learned to appreciate the value of businesses that have attributes other than strong cash flow generation, like billions of users or massive operating efficiencies. With the advent of the Internet and many other innovations, new business models have emerged. So, investors that do not evolve with technology tend to lag behind, which is one factor why, we believe, Berkshire has underperformed the S&P 500 in the last decade. (For reference, over 25% of the S&P 500 index is composed of companies in the technology sector.)

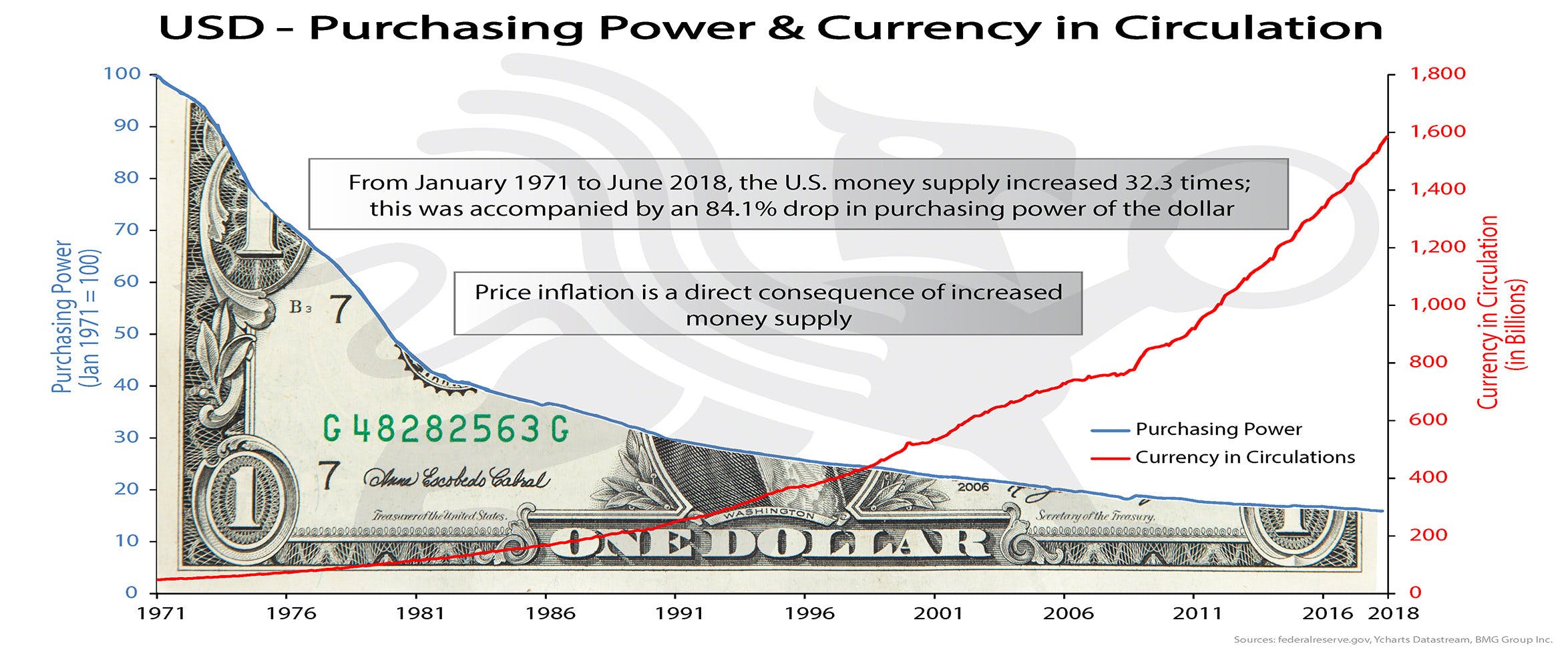

- Bitcoin also goes against everything Mr. Buffet believes in economics and, of course, poses a significant threat to the assets he invests in (the same applies to the other critics mentioned above). Warren Buffet became the richest person in the world by being an investor in a country that adheres to Keynesian economics, which is based on the belief that the government can positively affect the economy during downturn periods. In 1971, President Richard Nixon went off the gold standard, giving the U.S. Federal Reserve a unique ability to print dollars to manage the economy. Naturally, this power has been used extensively, especially in the last decade, which has caused significant inflation. From January 1971 to June 2019, the amount of dollars in circulation increased 32.2 times, which caused an 84.1% decline in purchasing power. (Please take a look at the graph below!) The question is: who has benefited from this? Well, certainly the top 1%, which hasn't had this much wealth since just before the Great Depression, but also the banks, which Mr. Buffet owns (incl. Bank of America, Wells Fargo, U.S. Bancorp, Goldman Sachs, and J.P. Morgan Chase) and were bailed out with these dollars in the 2008-09 Financial Crisis. So, unless Mr. Buffet owned bitcoin as a hedge to Berkshire's dollars or its dollar-denominated investments or generally as an investment, we should not expect him to make positive remarks about it, as he has a vested interest in its failure.

- Bitcoin is rooted on the in the principles of the Austrian School of economics, which we're sure most of you have never heard of, as it is not taught in academia today. An essential principle of this school of thought is personal freedom - the individual right of people to control their money, among many other things. As we have already discussed, fiat money - that issued by central banks - is controlled by governments (or, for those of you who still believe in central bank independence, at least is not controlled by you). Monetary policy decisions, which affect all of us, are dependent of the changing ideas of political parties, governments, and lobbying groups.

In Bitcoin, I am the king of my own money, as I hold the keys (think: passwords) that give me access to my bitcoins. They cannot be confiscated by any government and I can transfer them in a matter of seconds around the world without the need of a trusted intermediary, such as a bank like those owned by Berkshire (of course!). And, the Bitcoin network has been fully functional since inception 99.99% of the time. So, users are not subject to banking hours and system outages, like that of Wells Fargo earlier this month. Furthermore, Bitcoin is a scarce asset, like gold. Its supply is limited to 21 million and we all know exactly how and when new bitcoins are created. So, no additional bitcoins (or fractions of bitcoin) can be created after this limit is reached in the year ~2140. its scarcity allows it to retain value over time. Therefore, Bitcoin is 'sound money'. (For those interested in these topics, we highly recommend The Bitcoin Standard).

All of these reasons should be more than enough to at least consider the possibility that Bitcoin is a better alternative to existing, highly-inflationary fiat currency. It is objectively myopic to not assign a non-zero chance that Bitcoin (or some other sound money alternative with similar properties) will be successful.

"Every day that goes by and Bitcoin hasn't collapsed due to legal or technical problems, that brings new information to the market. It increases the chance of Bitcoin's eventual success and justifies a higher price."

- Hal Finney, Bitcoin's 2nd user after its creator, Satoshi Nakamoto (2011)

We are big fans of Warren Buffet and Charlie Munger. I (Allan) have personally read almost all of Berkshire's annual shareholder letters, as well as multiple books about investments they continually recommend, so I believe that I understand their philosophy. But, unfortunately, the world is not static. Or, as Bob Dylan eloquently put it, the times they are a-changin'. So, when an innovation of the magnitude of Bitcoin and blockchain technology in general is created, it is best not to dismiss it off-hand. At least, it makes sense not to do so with such authority, especially if one constantly preaches about knowing the limit of your own knowledge and being humble.

We will finish this letter with a fascinating anecdote of one of Mr. Buffet's best friends: Bill Gates. As we all know, in the early 1990s, Microsoft was, by a huge margin, the leader in the computing space, but they failed to notice the implications of the internet, unlike a group of 20-year olds, led by Marc Andreessen, who founded Netscape a couple of years back. In 1995, these kids released the Netscape Navigator, the company's web browser and it spread like wildfire. It was not until that moment that Microsoft started to pay attention. Its operating system became a mere life-support system for Netscape's browser. So, in May that year, Bill Gates wrote a now very famous internal memo entitled "The Internet Tidal Wave", in which he basically ordered his entire team to stop working on whatever they were working on and focus all their time on developing a web browser. Microsoft eventually came up with Internet Explorer, which became the world's browser and successfully killed Netscape.

This story serves to illustrate the risks of being complacent and blindly dismissing innovations that can change the world, and the benefits of being open to change. By empowering those who are substantially less well-off than Mr. Buffet and co., blockchain technologies have great potential to move the human race forward.

Disclaimer: The content in this letter is for informational purposes only. You should not construe any such information or other material as investment advice. Opinions, estimates and projections in this letter constitute our personal judgments, which are subject to change.